Economic Impact Payment

Frequently Asked Questions

How large a payment will I receive?

The CARES Act outlines the parameters of who is eligible to receive a payment. The Internal Revenue Service is the agency responsible for determining eligibility. In general, single adults with an adjusted gross income of $75,000 or less will get $1,200. Married couples earning a combined adjusted gross income of $150,000 or less will receive a total of $2,400. Individual and married taxpayers earning over $75,000 and $150,000 respectively will get reduced payments with full phase-outs at $99,000 and $198,000. There are additional $500 payments for dependent children.

For complete eligibility information please visit the IRS website.

Will college students be eligible to receive a payment?

The CARES Act definition of eligible individuals excludes those who are claimed as a dependent on another taxpayer’s return. Accordingly, to the extent a college student is claimed as a dependent on the tax return of a parent, he or she would not be eligible for the rebate.

For complete eligibility information please visit the IRS website.

When will I receive my payment?

The Department of the Treasury intends to send the payments out as soon as possible. If you filed taxes in 2018 or 2019 and included your bank routing and account number for payments or refunds, and this information has not changed, the IRS has the information it needs to send your payment electronically. This could be as soon as the middle of April, according to Treasury. In addition, for Social Security recipients, the IRS will use direct deposit by the Social Security Administration to facilitate payments. If the direct deposit information you have provided in the past is for a bank-issued prepaid debit card, you will receive your funds on that card account. Recipients will be mailed a check if the IRS does not have your information on file. Check payments will follow weeks or possibly months after the direct deposits are sent.

Learn more about NBC’s Economic Impact Payment Check Acceptance Policy

Can I receive my payment electronically if my current information is not on file with the IRS?

Treasury has announced that the IRS will create an online portal for individuals to provide their banking information to receive their payments faster. You will need your bank routing number and personal bank account number. At this time, the IRS online portal is under development. More information will be coming soon, and ABA will provide additional information as it becomes available.

While the IRS has extended the tax filing deadline this year from April 15 to July 15, another option is to file your 2019 taxes as soon as possible with bank routing and account number provided on the form.

What if I am typically not required to file a tax return?

People who typically do not file a tax return and are not Social Security beneficiaries will need to file a simple tax return to receive an economic impact payment. Certain low-income taxpayers, veterans and individuals with disabilities who are otherwise not required to file a tax return will not owe tax. IRS.gov/coronavirus will soon provide information instructing people in these groups on how to file a 2019 tax return with simple but necessary information, including their filing status, number of dependents and direct deposit bank account information. As noted above, Social Security recipients who have not been required to file tax returns will not be required to file a tax return to receive their payments.

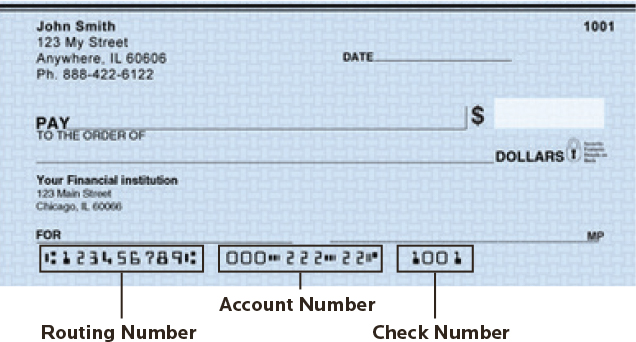

What is a bank routing and account number?

Bank routing and account numbers direct payments to the right bank account at the right financial institution. If you have a checking account at a financial institution the information is on the paper check. The bank routing number is on the lower left-hand side of the check and tells Treasury the correct bank to send the payment. Your individual account number is to the right of the routing number. That tells the bank to credit your specific account. Bank-issued reloadable prepaid debit card accounts have the same numbers, but the way they are provided to you will vary.

National Bank of Commerce’s routing number is 091800028.

How do I find this information if I can’t find my checkbook or was never issued any checks at all?

Log in to your bank account online or by mobile app. Bank routing and account numbers may be located in different places in your app or online if you are logging in from a laptop or PC, depending on your bank. If you can’t find it easily, search “bank routing” within the app or website. If you still can’t find the information or can’t log on, call your bank for more information. You can also look up your bank’s routing number at aba.com/routingnumber. Please remember that to protect your finances from fraudsters, banks will not provide your account number over the phone.

I have a reloadable prepaid card with a bank. Can I direct the payment to that account?

Yes, follow the same instructions to gather the routing and bank account numbers to provide via the IRS online portal.

I have a bank account. Can I still receive a paper check?

Yes, but be aware that your payment will be slower than an electronic transfer. Paper checks may be sent out weeks after the electronic checks are sent.

If you are willing to wait, we recommend that you deposit the check through remote deposit capture, if your bank offers this service. This is basically taking a picture of your check through your bank’s smartphone app. Follow the simple directions and you can make the deposit from the comfort and safety of your home the same day the check arrives in the mail.

The important thing to remember is that with branches closed or restricted, you may be required to visit a bank drive-through location if you want to deposit the check in person.

I don’t have a bank account, but want to receive my money faster. What can I do?

Search online for banks that offer digital account opening, and reach out to banks to see if they are offering new, flexible ways to become a customer. One type of bank account that accepts direct deposit is a bank-issued reloadable prepaid card often available at retailers that partner with a bank. Please make sure that the card is “reloadable” in order to receive direct deposit. When the account is open you will have the bank routing and account number to provide to the IRS. Please check with the bank you are working with to understand all of the terms and conditions of opening an account.

What can I do to prevent fraudsters from accessing my funds?

There will be a large amount of funds disbursed to qualifying individuals. Accordingly, there is a risk for fraud of various types. Protect yourself by reviewing the common risks and be on the lookout for these types of activities. Learn More